Global share markets rose over the last week. For the week the US S&P 500 rose 1.4% taking it above 5000 for the first time supported by ongoing confidence in a “goldilocks” landing for the US economy and strong earnings results. Eurozone shares rose 0.8% and Japanese shares rose 2%. Chinese shares gained 5.8% on news of more market support measures and stimulus. Despite the global gains Australian shares fell 0.7%, led particularly by resources shares and some disappointment that the RBA still retains a tightening bias. Bond yields pushed higher again as central banks pushed back against imminent rate cuts. Oil prices rose but metal prices fell, and the iron ore price stabilised after falls in the previous week. The $A rose slightly.

We remain of the view that shares have run a bit ahead of themselves and are now overbought and at risk of a short term correction – with risks around central banks and the timing of rate cuts, recession risks and various geopolitical issues (including the escalating Middle East conflict) all providing potential triggers.

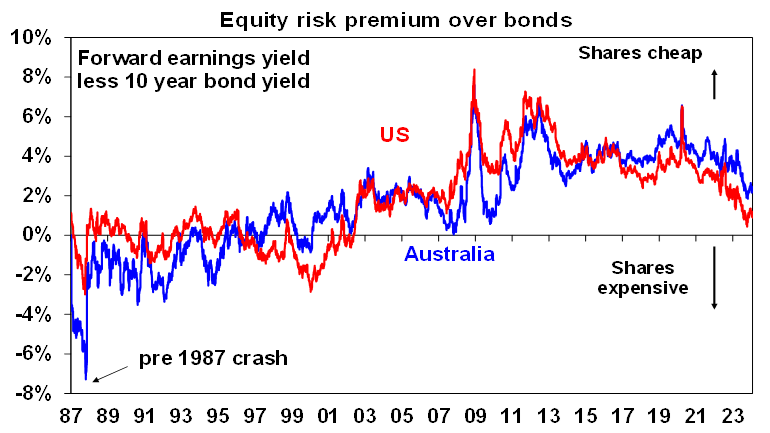

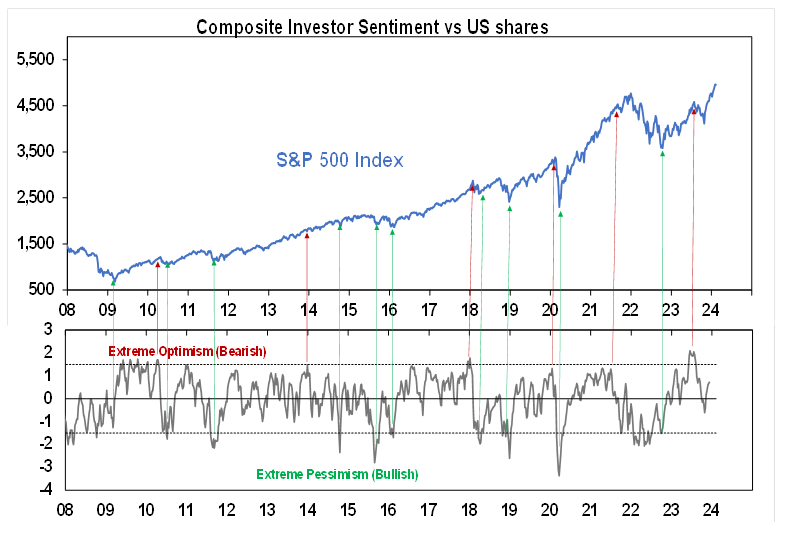

However, we would view any pullback or consolidation as a correction in the context of a continuing bull market. Valuation and sentiment measures are a bit stretched but are not at extremes (see the next two charts) and while central banks are generally cautious and keen to avoid cutting rates too early they are heading in the direction of lower interest rates this year. This included Fed Chair Powell who reiterated his wariness about cutting rates too early but continued to foreshadow the Fed cutting rates this year. For now, share markets don’t seem too worried about a possibly later start to rate cuts than expected a few weeks ago because it partly reflects stronger economic conditions, so rate cuts when they come may be more likely to be “good news cuts” (with low inflation) rather than “bad news cuts” (reflecting poor economic activity).

Source: Bloomberg, AMP

Source: Bloomberg, AMP

Out of interest, breaks above big round numbers like the US S&P has just done with 5000 tend to be positive for subsequent 12-month returns given a psychological boost they provide.

The bear market in Chinese shares may be nearing an end. After having nearly halved in value since it’s October 2021 peak Chinese shares are now undervalued (with a forward PE just below 10x), oversold and underloved and may be due at least a further bounce if there is more news of Government support.

RBA leaves rates on hold and is still cautious but has further dialled backed its hawkishness. In leaving rates on hold the RBA acknowledged faster progress in reducing inflation and bringing demand back into line with supply and it reduced its growth and inflation forecasts. It also further moderated its already mild tightening bias to “a further increase in interest rates cannot be ruled out.” Governor Bullock appeared to soften this a bit further in her Tuesday press conference saying that things are “broadly balanced.” But then she seemed a bit more hawkish in testimony before the House Economics Committee on Friday saying that “the Board hasn’t ruled out a further increase in interest rates but neither has it ruled it in”. Putting aside the perception of a slightly different tone in the messaging between Tuesday’s press conference and Friday’s testimony (which is inevitable with so many forums close together) the overall message is that while things are going in the right direction, inflation is still too high and demand still too strong and the RBA remains cautious wanting to see further evidence in order to be confident that inflation is sustainably heading back to target. In this sense its lagging behind the US which has already dropped its tightening bias and is signalling rate cuts this year – but this is not really surprising as US inflation led on the way up and is now further advanced in falling.

Our assessment remains that rates have peaked and that weaker growth and inflation than the RBA is expecting will drive rate cuts starting around mid-year with three 0.25% rate cuts by year end. We see inflation falling just below 3%yoy by September, which is a year earlier than the RBA is forecasting, and back to the mid point of the target range by the June quarter next year, which is also a year earlier than the RBA is forecasting. However, several things are worth noting.

- First, the road to rate cuts will likely be bumpy (as it is in other countries at present) as the RBA waits for more evidence in order to be confident as economic data waxes and wanes.

- Second, the RBA won’t necessarily wait until the 12 month ended inflation rate is at target but will likely move ahead of that. Governor Bullock has said “no, I don’t believe we..have to be in the band at 2.5%…before we think about” cutting the cash rate “but we do need to be very confident that we’re going to get there”. This could come if say the six-month annualised rate of inflation is back at the mid-point and other indicators line up.

- Third, absent an imminent crisis the risk is that the start of rate cuts is delayed to say August, possibly due to supply side shocks or the RBA wanting to see the impact of the Stage 3 tax cuts on demand.

- Three rate cuts this year will still leave mortgage rates well up on their 2021-22 lows. The money market is now pricing in an 60% chance of a cut by June and two cuts by year end.

- A risk for the RBA in waiting too long for evidence that inflation will be sustained at target is that it ends up making the same mistake but in the opposite direction as it made two years ago when it was too slow to start raising rates.

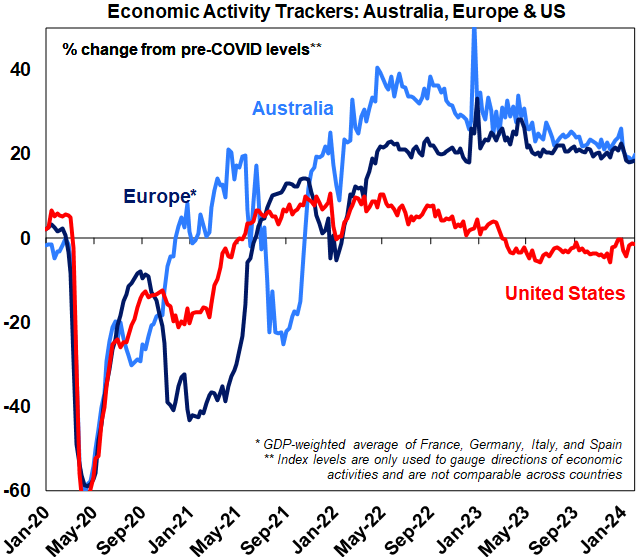

Economic activity trackers

Our Economic Activity Trackers rose a bit in the last week but are still not showing anything decisive.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence and credit & debit card transactions. Source: AMP

Major global economic events and implications

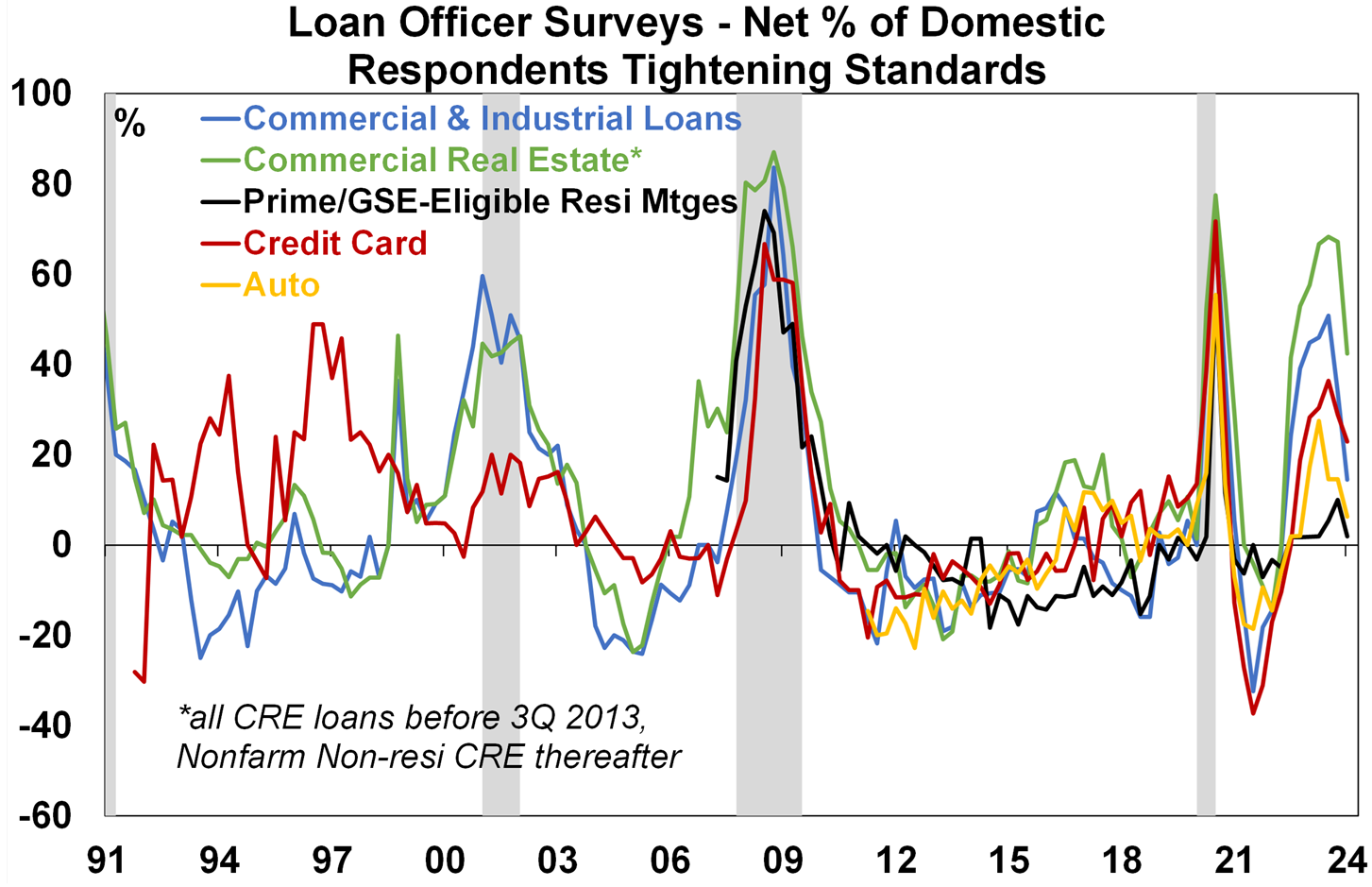

In the US, the Fed’s December quarter bank lending survey showed less tightening in lending standards and loan demand becoming less negative, which suggests an easing in the regional banking problems seen earlier last year. Of course, with monetary policy still tight and ongoing falls in commercial property values the problems could still return – as seen a week ago with New York Community Bank and Japan’s Aozora Bank.

Source: Bloomberg, AMP

Meanwhile, the services conditions ISM rose solidly in January suggesting strength and jobless claims fell. The annual revision to the US CPI reaffirmed progress in reducing inflation.

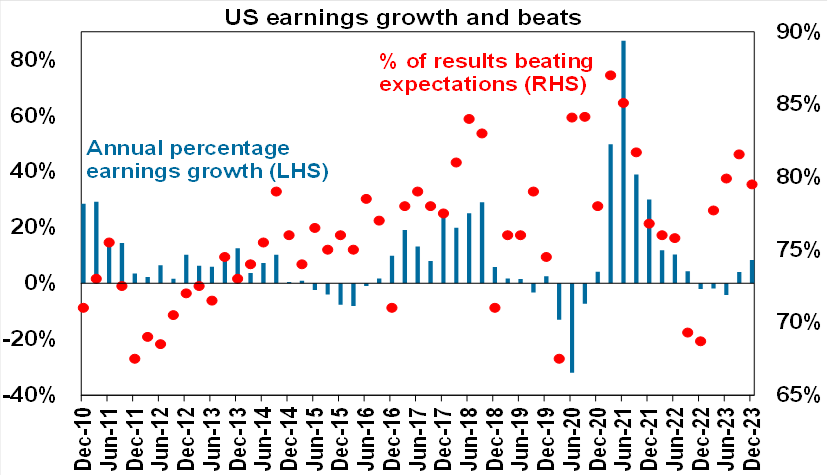

67% of US S&P 500 companies have now reported December quarter earnings with 79.3% coming in better than expected, which is above the norm of 76%. So far earnings growth for the quarter is running around +8%yoy, which is well up from consensus expectations for 4.3% growth at the start of the reporting season.

Source: Bloomberg, UBS, AMP

Eurozone retail sales fell in December and are down on a year ago highlighting its ongoing weakness relative to the US. Producer prices fell further in March and are down 10.6% on a year ago pointing to a further fall in consumer price inflation.

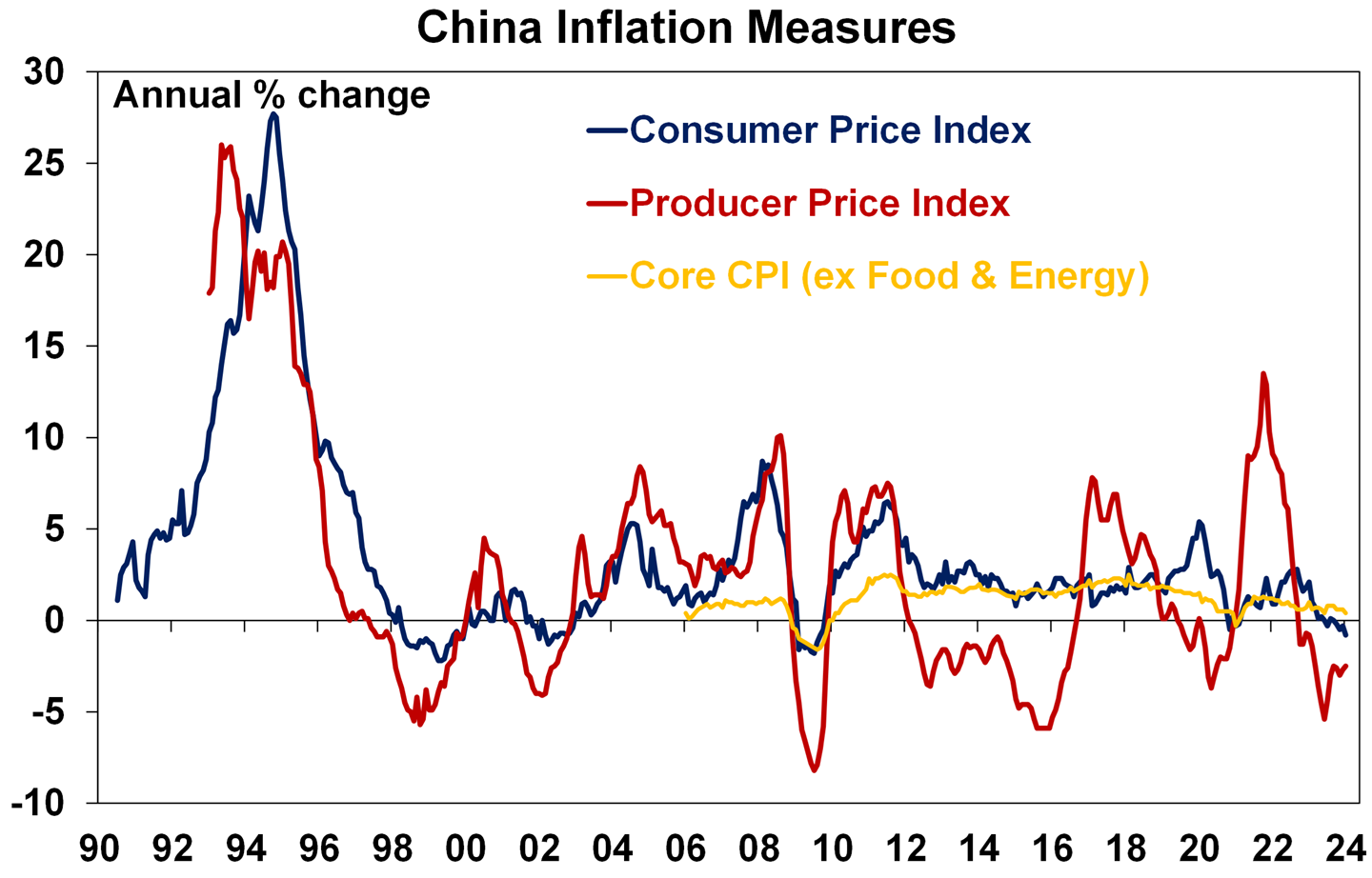

Chinese deflation continued in January with producer prices down 2.5%yoy and consumer prices down 0.8%yoy. Core CPI inflation slowed further to 0.4%yoy. This may have been exaggerated by a later Lunar New Year holiday this year. Chinese credit growth remained unchanged at 9.5%yoy in January.

Source: Bloomberg, AMP

Australian economic events and implications

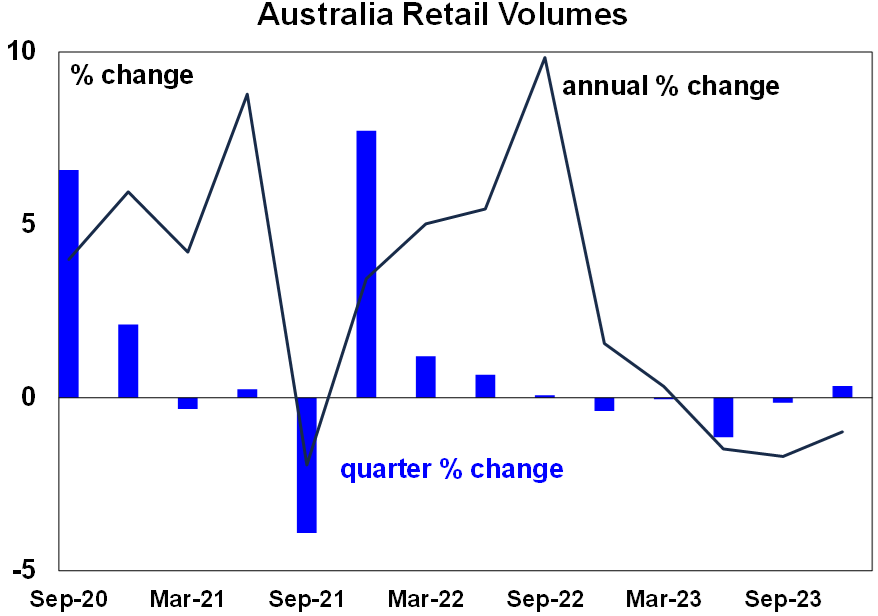

December quarter real retail sales surprisingly rose by 0.3% but this was due to a much weaker than expected rise in retail prices of just 0.1%qoq on the back of discounting in things like furniture and electronics with annual retail inflation falling to 2.4%yoy well down from its high a year ago of 7.6%. That said retail sales per person still fell 0.3% in the quarter and is down 3.5%yoy.

Source: ABS, AMP

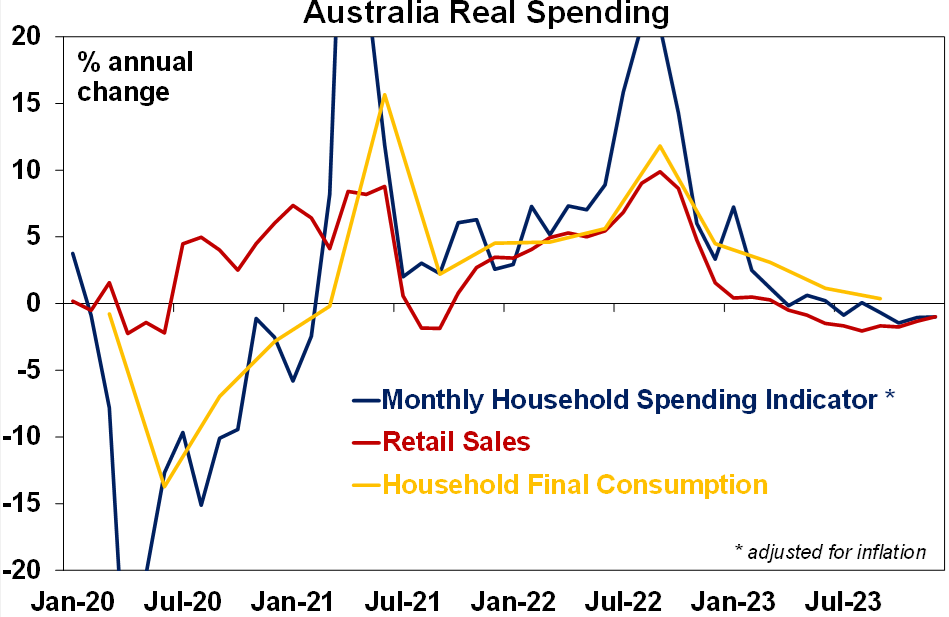

The ABS’s new nominal household spending indicator rose just 0.5% in December after November’s Black Friday boost with real annual growth still negative suggesting continued weak real annual growth in consumer spending despite the quarterly rise in real retail sales. It also shows that while non-discretionary spending rose 5.4%yoy, cost of living pressures saw discretionary spending go backwards at -0.6%yoy.

Source: ABS, AMP

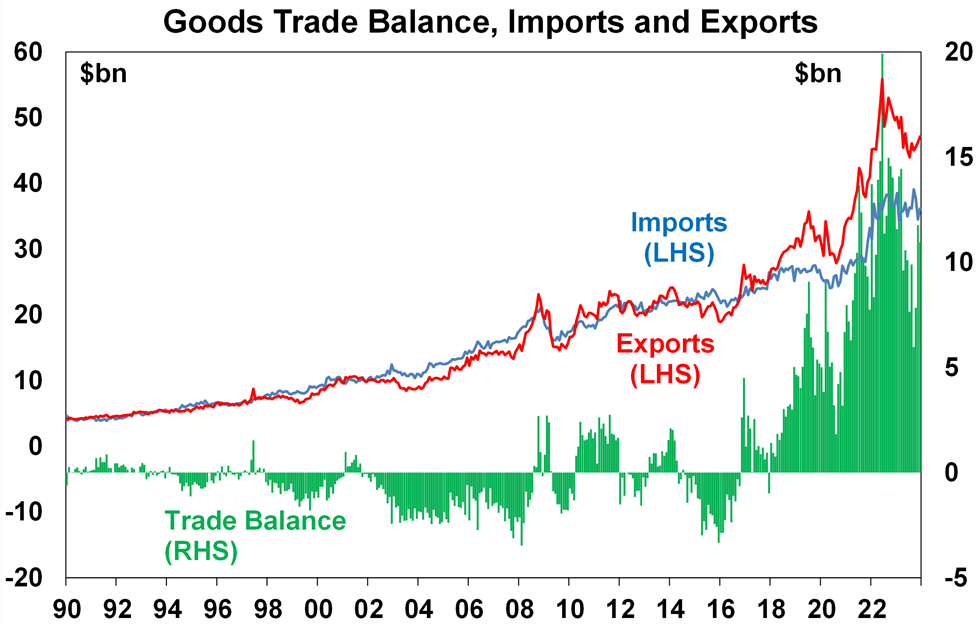

Australia’s goods trade surplus remained big in December with export values remaining high and the export share going to China continuing to recover. However, net export volumes look to have made a flat or slightly negative contribution to December quarter GDP growth.

Source: ABS, AMP

Swiftonomics. With Taylor Swift’s concert tour in Australia kicking off later this month interest in its economic impact will rebound again. Sure all the associated spending (on tickets, food, merchandise, flights, hotels, etc) will see consumers inject money into the economy but I reckon as Governor Bullock implied in relation to her own kids it will come at the expense of other things and of course much of the concert is an import. So maybe a brief spike in some activity around the concerts then back down such that the net impact on GDP will be hard to detect. Or maybe I am just still upset that I stuffed up getting the tickets which makes it a bit of a cruel summer.

What to watch over the next week?

In the US, the focus will be on CPI inflation data for January due Tuesday which is expected to rise 0.2%mom taking annual inflation down to 2.9%yoy from 3.4% with core inflation falling to 3.7%yoy from 3.9%. The New York and Philadelphia regional manufacturing surveys for February are expected to improve a bit but remain weak, with January retail sales expected to fall 0.2%mom and industrial production growth picking up to 0.4% (all Thursday). Housing starts (Friday) are expected to be flat and January producer price inflation is likely to remain around 1%yoy.

Japanese December quarter GDP growth (Thursday) is expected to be 0.3%qoq with flat consumer spending but contributions from capex and trade.

In Australia, consumer confidence data for February is likely to show a slight improvement on the back of more talk of rate cuts with business confidence in the January NAB survey remaining soft (with both due Tuesday). Jobs data for January (Thursday) is expected to show employment up by 35,000 after a slump of 65,000 in December with unemployment rising to 4%.

The Australian December half earnings reporting season will ramp up with nearly 50 major companies reporting including JB HiFi (Monday), Seven West (Tuesday), AMP, CBA & Seven (Wednesday), Origin, Treasury Wines & Wesfarmers (Thursday) and ASX & QBE (Friday). Consensus expectations are for a 5.4% fall in earnings for 2023-24 reflecting the slowdown in the economy and a sharp fall in energy profits but with strong gains in profits for utilities, health care and industrials. Key to watch will be guidance around how the consumer is holding up with high interest rates and cost of living pressures and the extent of cost cutting measures.

Outlook for investment markets for 2024

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for okay investment returns this year. However, with shares historically tending to fall during the initial phase of rate cuts, a very high risk of recession and investors and share market valuations no longer positioned for recession and geopolitical risks, it’s likely to be a rougher and more constrained ride than in 2023.

Global shares are expected to return a far more constrained 7%. The first half could be rough as growth weakens and possibly goes negative and valuations are less attractive than a year ago, but shares should ultimately benefit from rate cuts, lower bond yields and the anticipation of stronger growth later in the year and in 2025.

Australian shares are likely to outperform global shares, after underperforming in 2023 helped by somewhat more attractive valuations. A recession could threaten this though so it’s hard to have a strong view. Expect the ASX 200 to return 9% in 2024 and rise to around 7900.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

Australian home prices are likely to have a tougher year as still high interest rates constrain demand again and unemployment rises. The supply shortfall should provide support though and rate cuts from mid-year should help boost price gains later in the year.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.72, due to a fall in the overvalued $US & the Fed moving to cut rates earlier and by more than the RBA.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.